SOPHIA ANTIPOLIS, France – September 27, 2022 │ KnowMade’s experts in Semiconductor and Energy technologies have compiled an overview of Toyota’s patent strategy. Check out all the information through our four articles:

- Hydrogen-based Fuel Cell Electric Vehicles: a winning bet for Toyota?

- Toyota’s triptych IP strategy on batteries to conquer the EV market

- The vertical innovation path: from materials to power devices and their integration in electric vehicles (EV)

- Toyota Group, a leading IP player in the development of sensors and autonomous vehicles technologies

The automotive market is undergoing a major transformation. To comply with new regulations on CO2 emissions as well as providing safer driver-less vehicles, car makers must adapt to prepare for tomorrow’s vehicles, including electric vehicles (EV), hydrogen-fueled vehicles and autonomous vehicles (AV). Toyota was one of the first companies to put an electrical vehicle on the market in the form of the EV-RAV4, in the late 1990s. The EV-RAV4 had Ni-MH batteries provided by Panasonic. Unfortunately, these batteries used a patent held by GM Ovonics/Texaco, who sued Toyota and Panasonic for patent infringement. After that, Toyota had to postpone its ambitions in the EV market due to the nonrealistic conditions for accessing the battery technology from GM. Toyota therefore learned the importance of securing its intellectual property (IP) the hard way. Afterwards, Toyota seemed more reluctant to put all its technology developments in one basket, and started to change its IP and market strategies. Nowadays, Toyota commercializes a remarkably diversified range of vehicles including hybrid vehicles (HEV), fuel-cell electric vehicles (FCEV), and full battery EV (BEV). Toyota is keeping this diversification going with the recent development of several new product lines. Such a reorientation is strongly backed by a comprehensive IP strategy that includes most of the technologies related to next-generation vehicles.

Uncover Toyota’s strategy in EV markets by leveraging patent analysis

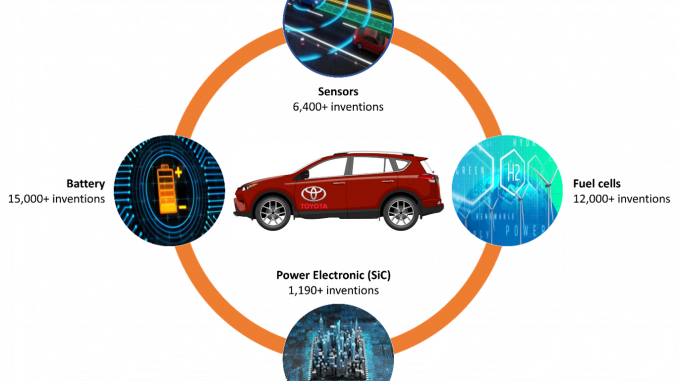

In a series of papers, KnowMade gives a new insight into Toyota’s strategy to prepare its transition towards EV, hydrogen-fueled vehicles, and AV. “By analyzing Toyota Group’s patent portfolio, we were able to perceive the strategies and technologies developed by each company of Toyota Group; understand their level of development, their roadmap and see how the IP and related R&D activities can impact the market,” explains Nicolas Baron, CEO of KnowMade. “In particular, KnowMade has highlighted how Toyota is using its IP to secure its position on key technologies, i.e., batteries, fuel cells, power electronics and autonomous vehicle sensors. Through technological analysis, KnowMade shows the level of development and related investment made by the company. It also indicates Toyota’s global vertical innovation strategy that allows the company to control and secure its position over the whole supply chain worldwide. Such a strategy is not unusual in the automotive IP landscape, but the intensity and diversity of Toyota’s patenting activity offer the company a unique IP position.”

Fig. 1: The Toyota patent strategy for next-generation vehicles exposed.

Leadership in building the fuel cell and hydrogen ecosystem

Full analysis on Toyota FCEV patent activity here: Hydrogen-based Fuel Cell Electric Vehicles: a winning bet for Toyota?

An early believer in FCEV technology…

Since the 2000s, Toyota has chosen to develop both the energy storage technologies that will be used in post-thermal vehicles: hydrogen fuel cells and batteries. Toyota is a trailblazing player for FCEV, with the commercialization of the Mirai Model in 2014, followed by a second generation in 2020.

For 20 years, Toyota Group has built up the largest patent portfolio worldwide related to fuel cells, resulting in more than 12,000 patented inventions. The company invested heavily in FCEV-related technologies in the 2000s, considering their benefits in terms of environmental impact, autonomy, and fast and easy refueling compared to other types of vehicles. Even after the crisis in 2008, when Toyota reoriented its priorities towards batteries, the group did not abandon its developments on fuel cell-related technologies (see Fig.2).

…with international ambitions in the future FCEV market…

As a global company in a competitive sector, Toyota aims to secure its market share all around the globe. One side of this strategy consists in filing patents in the locations of HFCEV production sites and where the most profitable markets are expected. Indeed, the protection of its inventions can provide Toyota with a truly competitive advantage over its competitors, in terms of performance and/or cost. According to the patent portfolio analysis, Toyota mainly targets Japan, USA, China, Germany and, to a lesser extent, the other European countries.

… leveraging synergies inside and outside the group…

Toyota Motor, representing about 75% of these patent filings, can rely on all its subsidiaries and affiliates to develop FCEV technology, such as Aisin Corp, Denso, Hino Motors, etc. Nonetheless, Toyota develops its skills in specific fields and creates an industrial emulation by forming external partnerships to speed up the innovative developments throughout the years, mostly with local Japanese companies, universities, and research institutes. In 2015, the Japanese automaker allowed royalty-free use of its then 5,000+ FCEV-related patent licenses in order to popularize FCEV and to support the development of the sector.

… across the whole FCEV supply chain…

The company does not focus on one fuel cell technology. Most of its patents deal with generic fuel cell technologies to keep the freedom to use any kind of fuel cell. The company first developed fuel cell components such as electrocatalysts, membrane electrode assemblies and stacking arrangements. Since 2016, Toyota has been diversifying its developments along the whole supply chain of FCEV and investigating other topics like the control of running parameters during fuel cell operation.

… and developing the complete infrastructure required for mass adoption of FCEV technology

Toyota Group has adopted a process of vertical integration of innovation throughout the whole hydrogen supply chain, from its production to infrastructure deployment and its use in Toyota’s FCEV. Toyota Group is also involved in the development of several emerging hydrogen production technologies, such as high-performing proton exchange membrane electrolyzers, solid oxide electrolysis cells (SOEC) and photocatalytic water splitting. Furthermore, its patenting activity also includes hydrogen carriers for transport and storage, such as metal-organic frameworks (MOFs). “By adopting such a global versatile and vertically integrated strategy, Toyota is a leader in the production of fuel cells and the hydrogen ecosystem,” says Arnaud Capgras, Technology and Patent Analyst Battery & Materials at KnowMade.

Fig. 2: Time evolution of Toyota Group’s patent publications related to fuel cells and batteries.

Toyota holds all the cards on batteries to successfully manage the transition towards EV

KnowMade’s latest work on Toyota’s batteries: Toyota’s triptych IP strategy on batteries to conquer the EV market

A leading innovator in the field of batteries for EV…

Toyota anticipated the move towards HEV and BEV several decades before it became a market target. Over the years, the company has developed a broad and diversified number of technologies linked to batteries, one of the key components influencing EV performances (autonomy, speed and safety). As part of its development strategy, Toyota has teamed up with a dense collaboration network on batteries in Japan and abroad. As a result, its innovations on batteries cover the whole supply chain for current and future promising technologies, and the company secured its IP position in key production and commercialization regions for batteries and electric vehicles (Japan, Korea, China, Europe, the US). Toyota shows a strong willingness to be involved in the improvement of battery performances (energy and power density, charging speed, life duration, etc.) and safety to meet EV market requirements. Toyota has chosen to work on the two main leads envisioned to reach these objectives: improve Li-ion batteries, the technology already used in electrical vehicles; and develop new battery technologies with outperformed characteristics.

… continuously improving the mainstream Li-ion battery technology…

On the one hand, the company is improving current and emerging materials for Li-ion batteries, i.e., lithium metal, lithium titanate (LTO / Li4Ti5O12) and silicon on the anode side, NMC/NCA, LFP and olivine silicates/phosphates on the cathode side, and solid electrolytes on the electrolyte side. It is worth noting that Toyota is today the most important patent assignee on solid-state batteries by far, with the strongest IP position along the whole supply chain.

… while exploring the benefits of new technologies

On the other hand, Toyota is investigating new battery technologies with higher theoretical performances than Li-ion batteries. The company not only works towards well-known post Li-ion technologies, i.e., Li-air, Li-S and Na-ion batteries, but also on more emergent technologies such as Mg-ion, F-ion, Al-ion, Ca-ion, K-ion and Zn-ion batteries. “Thanks to its strategy, Toyota can control and secure its IP for every material, component and manufacturing process of the battery cells and packs that will be used in its vehicles,” concludes Dr Fleur Thissandier, PhD, Technology and Patent Analyst Battery & Materials at KnowMade.

Toyota joins forces with Denso to develop SiC power devices for EV applications

Our comprehensive analysis of this strategy: The vertical innovation path: from materials to power devices and their integration in electric vehicles (EV)

KnowMade has leveraged its know-how in patent analysis to describe Toyota’s innovation strategy in the field of power chips and power modules. The analysis focuses on power silicon carbide (SiC) technology as a must-have technology for the next generations of electric vehicles (EV).

Fig. 3: Time evolution of Toyota Group’s patent publications related to silicon carbide (SiC). Patents published up to August 2021.

The article provides a comprehensive overview of Toyota’s SiC activities from an IP perspective, shedding new light on:

The strong synergy between Toyota Motor and Denso

The collaboration between both companies started a long time ago in the areas of SiC crystal growth technology and SiC power devices. Nevertheless, they brought it to another level in the early 2010s, and started focusing increasingly on the development of trench SiC MOSFET technology. Since 2018, Denso has taken the lead in the development of SiC MOSFET. Accordingly, Toyota Motor transferred its key patents to Denso in view of the integration of SiC MOSFET in next-generation EV.

The vertically integrated innovation strategy within Toyota Group

Toyota and Denso’s patenting activity extends across the whole supply chain, from SiC materials to SiC power devices, modules and circuits (Figure 3). Moving down the SiC supply chain, Toyota’s IP activity puts the emphasis on inventions providing the company with a competitive advantage in EV applications.

The diversification of technological approaches developed within Toyota Group

Up the supply chain, Toyota’s patent portfolio features very broad technology coverage, addressing the mainstream SiC crystal growth technology (PVT) but also alternative methods (CVD, solution growth).

Such broad coverage of SiC substrate technology provides Toyota with the ability in the mid- or long-term to lift most technological barriers related to SiC materials in terms of cost, quality or size of the wafers.

Toyota’s stand-out IP collaborations

For instance, the collaboration with Kwansei Gakuin University provides a very innovative approach to alleviate the shortage of high-quality, large-area, low-cost SiC wafers. Toyota and Kwansei Gakuin University co-filed more than 15 related patents since 2019.

Other examples include the collaboration with University of Illinois to develop an inverse opal structure (MIO) which provides a compact bond layer in power electronics assemblies. Another notable collaboration took place with Virginia Tech in the field of SiC circuits in the late 2010s.

Toyota’s EV activities, driving multiple innovations in power electronics

The patent analysis reviews the development of power card resin-molded packages with a double-sided cooling (DSC) structure for 2-in-1 power modules to be used in EV, emphasizing innovative approaches for electrical interconnections and their encapsulation in resins. Interestingly, Toyota Motor has been pioneering the TLP bonding technique for die-attach technology since 2010, which represents a promising alternative to conventional solder techniques and silver or copper sintering techniques for high-temperature operation.

The global IP strategy, as reflected by Toyota’s SiC patent portfolio

According to our analysis, Toyota has built a consolidated IP position in the US and Japan, and now the group is extending its patenting activity to other strategic markets for SiC technology, such as Europe and China.

In conclusion, the analysis of its patent portfolio positions Toyota as a leading innovator in power SiC. “The Japanese corporation has designed an innovation strategy to build up strong expertise internally, all along the supply chain of power SiC technology, while maintaining access to multiple external innovation sources such as collaborations, development and production partnerships,” concludes Dr Rémi Comyn, PhD, Technology and Patent Analyst Power Electronics & Compound Semiconductors at KnowMade. This innovation strategy aims to provide Toyota with one of the most competitive SiC technologies for EV applications, and is combined with a global IP strategy which will certainly support the development of its business related to BEV, HEV and FCEV internationally.

Autonomous vehicles, a singular approach

Key points about Toyota and ADAS detailed in our article: Toyota Group, a leading IP player in the development of sensors and autonomous vehicles technologies

Autonomous vehicles (AV) and robot taxis are the second revolution that the automotive industry is preparing. However, while electrification is already well implanted with the release of HEV and BEV, the launch of robot taxis and fully autonomous vehicles is taking a little more time.

Toyota enters the competition with a strong legacy in developing sensor technologies…

Toyota’s current investments to develop AV could be linked to the group’s recent patenting activity. With a CAGR of +16% between 2011 and 2020, more than 900 new inventions published in 2020, the IP activity of Toyota Group related to advanced driver assistance systems (ADAS) and AV technology is among the most dynamic IP domains of the group. Such an increase in R&D activity is necessary to be able to compete against other automakers like Volkswagen, Audi, Mercedes and Ford, but also against the robot taxi-making newcomers, especially in the US (Waymo, Uber, Zoox, etc.). Furthermore, strengthening and enlarging its IP portfolio allows Toyota to secure its products and offers the group a set of tools to fight against its competitors, who have also enlarged their patent portfolios hugely.

… but a singular development strategy focused on cameras…

Today, Toyota’s developments benefit from Toyota Group’s early patenting activity related to cameras, radars and lidars, which are considered the three main technologies that need to be combined to achieve 3D mapping of the vehicle environment. Indeed, Toyota appears to be a pioneer and leader in the development of ADAS and AV. However, while most of its competitors are fiercely investing and enlarging their portfolios related to lidar technology, the Japanese corporation has chosen to reduce its lidar R&D activity, as shown by the patenting activity slow-down. Today, Toyota’s efforts are targeting solutions to integrate and control multiple sensors and especially cameras in a vehicle. The company IP position is becoming stronger further down the supply chain, ensuring its position as an integrator and operating system provider. On the upper part of the supply chain, Toyota Group benefits from its past IP activity. Once again, Toyota’s patenting activity shows a will to control and protect all key links of the supply chain.

… to enable reliable and cost-effective AV that leverage the advances in computing systems.

By developing computing solutions and related IP, Toyota is progressively strengthening its IP position down the supply chain and controlling its inventions from the sensor devices to their integration and use in a vehicle. This vertical integration is in good alignment with Toyota’s strategy in the EV market. Furthermore, computing is the key that could unlock the full potential of the AV system. This is especially the case when using cameras. To do so, computing systems must manage a high volume and variety of data rapidly, efficiently and without errors to allow quick and safe decision making by the vehicle. All these developments will contribute to the release of the flagship Crown model that will include an automated driving system with hands-free capability on the highway. According to Nikkei’s newspaper, Toyota aims to provide an autonomous driving system by 2025.

Conclusion

Toyota’s patenting activity reflects the company’s will to be a major player in the development of tomorrow’s vehicles. To avoid its past mistakes, Toyota Group has adopted a vertical innovation IP strategy. In all major fields (e.g., battery, fuel cells, sensors, power electronics), Toyota has filed a significant number of patents to cover everything from materials to systems, including devices, control circuits and packaging. What’s more, Toyota has also enlarged its technological coverage to emerge as an IP leader in past, present and future key technologies. Such an IP strategy is not unique, but Toyota has successfully secured and strengthened a portfolio with valuable and enforceable patents. Furthermore, Toyota’s recent high patenting activity and strong IP position offer a solid base to build its market position in the emerging markets that are EV and AV. Moreover, it ensures the company is able to assert its inventions and defend its position all around the world for years to come.

Related KnowMade reports:

- Battery patent analysis

- Fuel cell patent analysis (coming soon)

- Power electronics patent analysis

- MEMS, Sensing & Imaging patent analysis

Press contact

Le Drakkar, 2405 route des Dolines, 06560 Valbonne Sophia Antipolis, France

About our analysts

Fleur Thissandier works for KnowMade as a Patent Analyst in the field of Materials Chemistry and Energy storage. She holds a PhD in Materials Chemistry and Electrochemistry from CEA/INAC, (Grenoble, France). She also holds a Chemistry Engineering Degree from the Superior National School of Chemistry (ENSCM Montpellier, France). Fleur previously worked in battery industry as R&D Engineer.

Arnaud Capgras works for KnowMade as a Patent Analyst in the field of Materials Chemistry and Energy storage. He holds a Chemistry-Process Engineering Degree from the Chemistry and Chemical Engineering School of Lyon (CPE Lyon, France). He also holds the International Industrial Property Studies Diploma (Patents) from the CEIPI (Strasbourg, France).

Jonathan Dominici works for KnowMade as a Patent Analyst in the field of Material Chemistry and Energy Storage. He holds a Master’s degree in Materials Science and Engineering from the Grenoble Institute of Technology (France) with a specialization in Technological Innovation Management. He previously worked in Competitive Intelligence and IP Strategy within a research institute and a consulting firm.

Rémi Comyn works for KnowMade as a Patent Analyst in the field of Compound Semiconductors and Electronics. He holds a PhD in Physics from the University of Nice Sophia-Antipolis (France) in partnership with CRHEA-CNRS (Sophia-Antipolis, France) and the University of Sherbrooke (Québec, Canada). Rémi previously worked in compound semiconductors research laboratory as Research Engineer.

Paul Leclaire works for KnowMade as a Patent Analyst in the fields of RF technologies, Wireless communications and MEMS sensors. He holds a PhD in Micro and Nanotechnology from the University of Lille (France), in partnership with IEMN in Villeneuve-d’Ascq and CRHEA-CNRS in Sophia Antipolis (France). Paul previously worked in innovation strategy consulting firm as Consultant.

About KnowMade

KnowMade is a technology intelligence and IP strategy consulting company specialized in analyzing patents and scientific publications. The company helps innovative companies, investors, and R&D organizations to understand their competitive landscape, follow technological evolutions, reduce uncertainties, and identify opportunities and risks in terms of technology and intellectual property.

KnowMade’s analysts combine their strong technology expertise and in-depth knowledge of patents with powerful analytics tools and methodologies to turn patent information and scientific literature into actionable insights, providing high added value reports for decision makers working in R&D, innovation strategy, intellectual property, and marketing. Our experts provide prior art search, patent landscape analysis, freedom-to-operate analysis, IP due diligence, and monitoring services.

KnowMade has a solid expertise in Compound Semiconductors, Power Electronics, Batteries, RF Technologies & Wireless Communications, Solid-State Lighting & Display, Photonics, Memories, MEMS & Sensors, Semiconductor Packaging, Medical Devices, Medical Imaging, Microfluidics, Biotechnology, Pharmaceutics, and Agri-Food.